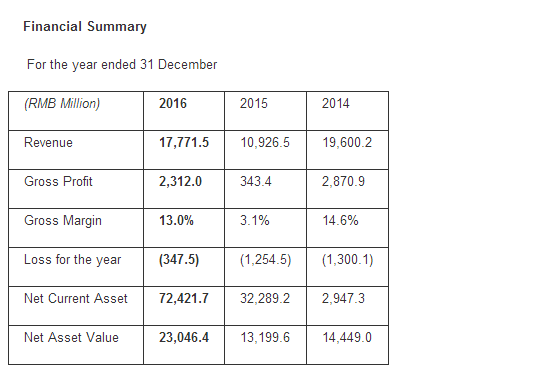

(26 March 2017 - Hong Kong) – Kaisa Group Holdings Limited (“Kaisa” or the “Company”, SEHK stock code: 1638, together with its subsidiaries, the “Group”) announces today its annual results for 2014 to 2016 (year ended 31 December). Financial summary is consolidated as below:

Going through a series of incidents since the end of 2014, Kaisa announced it has fulfilled all the resumption conditions, and the trading of the Company’s shares is going to resume at 9:00 am on 27 March 2017.

Looking back 2016, the Company’s operation was back on track with sales steadily increasing.Leveraging the booming demand in the property market in major cities, the Group actively accelerated sales of projects in first tier cities and key second tier cities. Benefitting from its successful implementation of development strategies in the first tier cities and key second tier cities, the Group’s contracted sales increase significantly by 222% to approximately RMB29.8 billion for the year ended 31 December 2016, setting a new record for the Group. In particular, sales from first tier and key second tier cities contributed to over 90% of the total contracted sales. Gross floor area (“GFA”) sold for the year was approximately 2.27 million sq. m., representing an increase of 81% year-on-year. Average selling price (“ASP”) of the contracted sales increased by 78% year-on-year to RMB13,150 per sq. m..

With respect to land acquisitions, the Group acquired land parcels through public tender, merger and acquisition, cooperative development, and urban renewal to prudently replenish its land bank. In 2016, the Group acquired land parcels in Shenzhen, Huizhou, Wuhan and Chongqing for a total consideration of RMB7.9 billion with a GFA of 1.62 million sq. m.. The average land cost of these newly acquired land was approximately RMB4,900 per sq. m. As at 31 December 2016, approximately 80% of the Group’s 21 million sq. m. land bank was located in the first tier cities and key second tier cities.

Urban renewal has been an important channel for Kaisa to replenish high-quality land bank in first tier cities where the supply of land is scarce. In 2016, the Group continued to leverage its strengths in urban re-development accumulated over the years, facilitated supply of land through re-development projects including Shenzhen Pinghu old town project, Shenzhen Argent project, Shenzhen Yantian project and Zhuhai Wanzhai project. These will in turn provide high quality land bank to support the Group’s sustainable development at low costs.

In terms of financing, the Group completed the restructuring of its offshore debts in July 2016. The original offshore debts were exchanged for new notes with the necessary consent of offshore creditors. As for onshore debts, the Groups has also completed the restructuring arrangements with banks and financial institutions, including extension of payback period, obtaining new loans and refinancing. In 2016, the Group has successfully entered into strategic cooperation agreements with financial institutions including China CITIC Bank and Ping An Bank, lending strong support to its return to rapid business development.

With respect to financial management, the Group strengthened its cash position by implementing reasonable pricing strategy and accelerating collection of sales proceeds. Meanwhile, the Group strived to explore various financing channels with a view to lowering its finance costs and improving its debt structure.

When commenting on the Company’s development, Mr. Kwok Ying Shing, Chairman of the Group, said, “looking back over the challenges in the past two years, our employees’ full devotion to the Group, along with the support from our business partners and creditors, have fueled our courage and zeal to work with the relevant authorities and parties to resolve the issues surrounding us. On behalf of the Board, I would like to express my wholehearted gratitude to all shareholders of the Company, investors, business partners and customers.”

“In 2017, the comprehensive easing credit environment may come to an end, while the effects of curbing measures targeting major cities still linger. However, the deepening of supply-side reforms together with the measures to revive the real economy taken by the Central government will provide a favorable environment for the real estate market to achieve stable development in the long term. Against this backdrop, the Group will further penetrate first tier cities and key second tier cities, and speed up the value realization of the urban re-development projects. By providing high quality products and services, the Group strives to accelerate turnover of its capital, maximize profit from its projects and deliver greater value to its shareholders. Meanwhile, the Group will strengthen its cash flow management, increase efficiency in usage of funds, actively widen its financing channels, lower its finance costs and optimize its debt structure.”